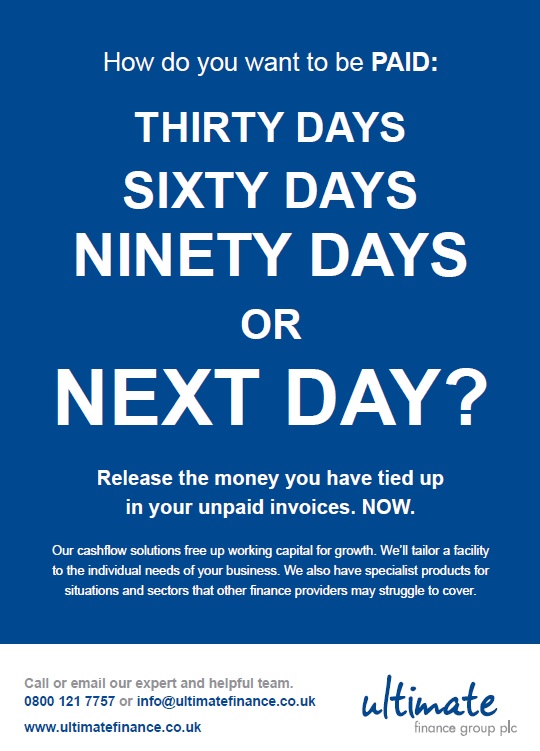

Why wait 30, 60 or 90 days to get paid?

Ultimate Finance

This company, launched in 2002, has grown rapidly to become one of the UK’s largest and most successful independent providers of cashflow solutions to SMEs.

Originally they offered factoring and invoice discounting services but have recently added asset finance and developed innovative specialist trade finance, construction finance, recruitment finance and transport finance offerings, along with a cutting edge online platform for providing SMEs with short term business loans.

How our involvement with Ultimate Finance has developed

I started working with them about eight years ago, writing financial statements for the city on behalf of the CEO, as well as quarterly newsletters for the network of brokers, accountants and lawyers who referred business to them.

As the company was evolving rapidly I wrote a whole new website. To underpin this I interviewed a number of their clients and produced a collection of case studies and customer success stories.

Then, a couple of years later I helped them rebrand. I also helped them start marketing direct to SMEs as well as continuing to work with their network of introducers. This involved writing another entirely new website, as well as creating fresh sales literature, exhibition stands, presentations and product fact sheets. I was also asked to develop concepts and copy for their advertising campaigns.

Next I was asked to add a PR role, writing regular press releases and articles to go in financial journals and business publications. This soon extended into writing regular blog posts.

What’s the story?

There are two strands to it.

The first involves selling the idea of asset based finance to SMEs (where you use your unpaid invoices as an asset against which a provider loans you money in advance of your client settling the bill). This is quite a delicate task because financial institutions have hardly been popular since the banking crisis, mis-selling scandals, Libor fixing revelations and general bonus bingeing. Wonga hasn’t helped either.

The second involves differentiating Ultimate from their competitors and making those differences attractive to SMEs and intermediaries. Again this is quite a tough call – The Asset Based Finance Association alone has over 40 members and the whole “alternative finance” space is extremely crowded.

Spot the difference

The key differentiator is attitude and approach. The traditional high street banks have always been cautious and unhelpful when it comes to SME lending. And they’ve been even more so whilst rebuilding their balance sheets after the banking collapse. These large organisations tend to look for reasons not to provide funding, adhere rigidly to inflexible lending criteria, and have tortuous application procedures that often end with “computer say no”. They would argue this criticism is unfair but the Bank of England’s lending figures over the last five years suggest that much of this is true.

The narrative we’ve created for Ultimate is the polar opposite of this. They have an appetite to lend to SMEs. They are flexible and helpful – they take time to really understand how a business operates so they can find responsible ways to say “yes”. They move fast, coming up with decisions and funds in days not weeks or months.

The truth well told

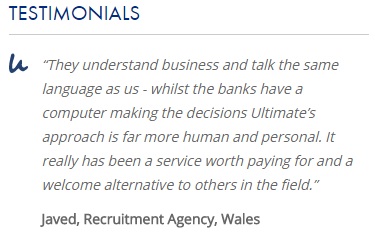

There’s ample evidence to support this. My job is to communicate the facts through case studies, blog posts, press articles, web pages and other marketing materials. This has involved me in developing a good understanding of the main financial issues affecting not just SMEs as a whole, but a number of niches as well – specialist subcontractors in the construction industry, recruitment consultancies, transport operators and importers. I also have to pro-actively follow these sectors in search of stories I can comment on and which demonstrate the value of Ultimate’s services.

A client that’s a pleasure to work with

As a freelancer who has worked with a lot of clients over the years you realise that every company has its own very distinct character and culture. This is reflected in the way they treat their suppliers. Many members of the finance industry have behaved very badly over recent years. The people I have met at Ultimate, however, have impressed me immensely.

Whilst in the business of making money they genuinely care for their clients – they are looking for ways to help them, rather than just screw fees out of them. This is reflected in the fact that their client retention levels are good, and that they are steadily attracting more customers all the time. I’ve also interviewed a lot of those clients and had some very frank feedback about the attitude of the banks and how much better the Ultimate experience has been.

On a personal level the team at Ultimate has been a pleasure to work with. I’ve found them immensely helpful, open, thoughtful, respectful, professional and human – they are thoroughly nice people who take real pride and pleasure in what they do. Together we work hard, but they make it fun and are very quick to show their appreciation. In today’s fast paced and impersonal business environment I find these values have been pushed out. I love working with Ultimate Finance. I believe that what they are doing in terms of supporting the growth of SMEs (when so many others just talk the talk), and the way they are doing it in terms of behaving well, is terrific. When you are asked to help promote a business like that the job feels really good – much better than trying to make a mediocre organisation or product look better than it really is.

A client that is growing really fast

Because the company is performing a valuable service and doing it with integrity, the business is growing very fast. I’m writing this in the summer of 2015. Over 2014 the company more than doubled the number of invoice finance deals it did every month and that growth is continuing to accelerate – every month they are breaking their previous record. Over those 12 months clients grew by 36.3% to 1,323. The amount of money they had out on loan loan increased by 60.8% to £66.9 million. And their back-to-back funding facility with Lloyds Bank increased to £50 million. In March 2015 their funding received a further boost to £75 million following an agreement with the British Business bank to provide an additional £25 million.

In that period Ultimate doubled the sales force to cope with the rocketing level of sales enquiries. They’ve done this by successfully attracting some of the best talent in the industry from competitors – a huge vote of confidence from people who know what’s really going on in this sector.

Obviously this growth is not entirely down to the marketing, but we must be doing something right!